Strong passenger & freight growth at European airports during Q1

- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Posted: 16 May 2017 | Airports Council International (ACI) Europe, International Airport Review | No comments yet

European airport trade body, ACI Europe releases its air traffic report for March and Q1.

The report is the only air transport report which includes all types of civil aviation passenger flights: full service, low cost and charter. It reveals that during the first quarter of this year, passenger traffic at Europe’s airports grew by an average +6.9%.

EU airports remain ahead

More specifically, the EU market maintained a dynamic growth trajectory with passenger traffic increasing by +7.2% during Q1. Within the EU, 11 national markets recorded double-digit growth – mostly in the Eastern part of the bloc along with Cyprus, Luxembourg, Malta and Portugal.

Accordingly, many airports posted an impressive performance: Cluj (+60.1%), Sofia (+46.9%), Warsaw WAW (+28.5%), Larnaca (+26.9%), Malta (+22.1%), Bucharest-Otopeni (+21.4%), Lisbon (+21.2%), Porto (+19.9%), Krakow (+19.1%), Prague (+18.8%), Prague (+18.8%), Tallinn (+18.3%), Ljubljana (+17;5%), Budapest (+14.5%), Vilnius (+14.4%) and Luxembourg (+13.5%).

Non-EU airports making ground

Meanwhile, passenger traffic in the Non-EU market grew at a slower but nevertheless gradually increasing pace in Q1 – at +5.9%. As a result, the non-EU market ended up outperforming the EU one in March (+7.4% vs. +6.4%). This improvement was driven by increasing volumes at Russian, Ukrainian and Norwegian airports – as well as by Turkish airports experiencing nearly flat growth in March (-0.3%) after months of losses.

The following airports were amongst the best performers in the Non-EU market for Q1: Keflavik (+53.7%), Rostov (+38.6%), Kiev-Borispyl (+32.2%), Novosibirsk (+27.8%), St Petersburg (+26.8%), Ekaterinburg (+20.9%), Moscow-Sheremetevo (+16.8%) and Samara (+15.6%).

The Majors (top 5 European airports), saw passenger traffic increasing by +1.9% in Q1 (compared to an average of +1.5% in 2016). Amsterdam-Schiphol kept leading the league in terms of growth (+8.6%), followed by Paris-CDG (+4.3%), London-Heathrow (+2.2%) and Frankfurt (+1.5%). In a sharp contrast, Istanbul-Atatürk was still down nearly 900,000 passengers (-7%).

Freight traffic across the European airport network improved markedly during Q1 at +8% – with March posting the best monthly performance since April 2011 (+13.7%). Aircraft movements were up +3.0%.

Olivier Jankovec, Director General of ACI EUROPE said “The momentum for traffic growth is holding on and it may well continue to do so in the coming months. The risk of increased political instability for the EU has just receded with the results of the French elections – a very positive factor for our industry. The return of a growth dynamic for freight reflects increasing trade, business confidence and the fact that other leading indicators are showing the economy is on the up – especially in the Eurozone.”

He added “However, we need to be cautious in our optimism given that the wider geopolitical environment remains more unstable than ever. The on-going uncertainty over the implications of Brexit for aviation is unlikely to be resolved quickly – and this might end-up limiting airline capacity growth and network development opportunities for some airports, especially in the UK.”

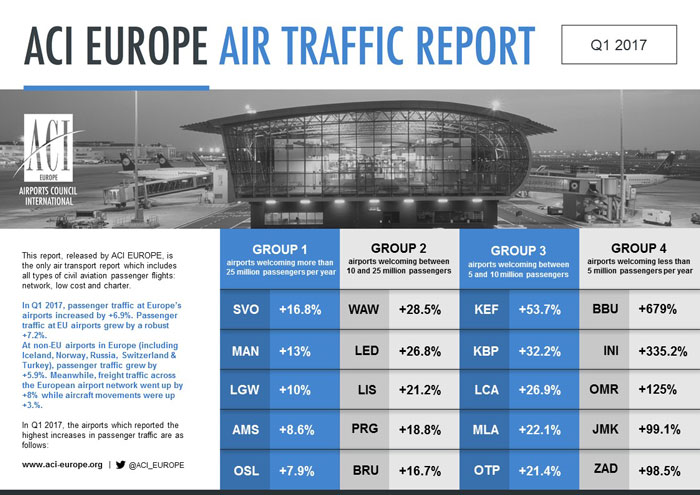

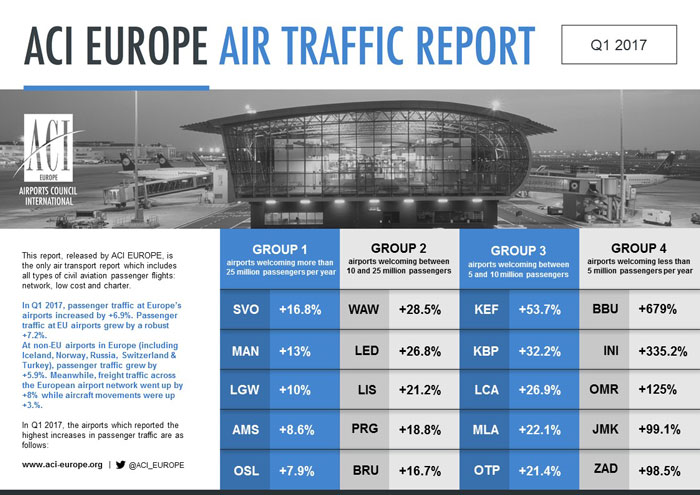

During Q1, airports welcoming more than 25 million passengers per year (Group 1), airports welcoming between 10 and 25 million passengers (Group 2), airports welcoming between 5 and 10 million passengers (Group 3) and airports welcoming less than 5 million passengers per year (Group 4) reported an average adjustment +4.3%, +9.0%, +10.0% and +9.4%.

The airports that reported the highest increases in passenger traffic are as follows:

GROUP 1: Moscow SVO (+16.8%), Manchester (+13.0%), London LGW (+10.0%), Amsterdam (+8.6%) and Oslo (+7.9%)

GROUP 2: Warsaw WAW (+28.5%), St Petersburg (+26.8%) Lisbon (21.2%), Prague (+18.8%) and Brussels (+16.7%)

GROUP 3: Keflavik (+53.7%), Kiev (+32.2%), Larnaca (+26.9%), Malta (+22.1%), Bucharest OTP (+21.4%)

GROUP 4: Bucharest BBU (+679.0%), Nis (+335.2%), Oradea (+125.0%), Mikonos (+99.1%) and Zadar (98.5%)

March figures:

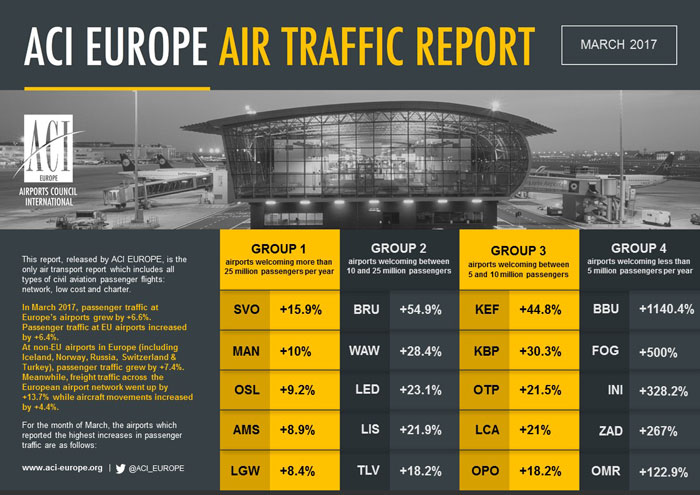

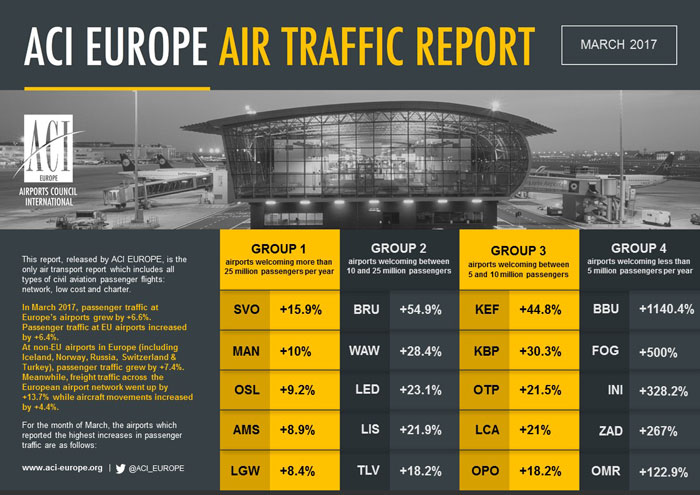

During the month of March, average passenger growth was +6.6%. Freight reported an exceptional increase of +13.7% and movements were up +4.4%. Airports welcoming more than 25 million passengers per year (Group 1), airports welcoming between 10 and 25 million passengers (Group 2), airports welcoming between 5 and 10 million passengers (Group 3) and airports welcoming less than 5 million passengers per year (Group 4) reported an average adjustment +4.1%, +11.0%, +9.2% and +8.8%.

For March, the airports which reported the highest increases in passenger traffic are as follows:

GROUP 1: Moscow SVO (+15.9%), Manchester (+10.0%), Oslo (+9.2%), Amsterdam (+8.9%), London LGW (+8.4%)

GROUP 2: Brussels (+54.9%), Warsaw WAW (+28.4%), St Petersburg (+23.1%), Lisbon (+21.9%) and Tel Aviv (+18.2%)

GROUP 3: Keflavik (+44.8%), Kiev (+30.3%), Bucharest OTP (+21.5%), Larnaca (+21.0%) and Porto OPO (+18.2%)

GROUP 4: Bucharest BBU (+1,140.4%), Foggia (+500.0%), Nis (+328.2%), Zadar (+267.0%) and Oradea (+122.9%)

The ‘ACI EUROPE Airport Traffic Report – March & Q1 2017’ includes 232 airports in total representing more than 88% of European air passenger traffic.