Airport aeronautical revenues plummeted 65 per cent in 2020 according to ACI World data

- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Posted: 18 May 2022 | International Airport Review | No comments yet

The latest ACI data provides new insights into airports’ financial health during the first year of the pandemic

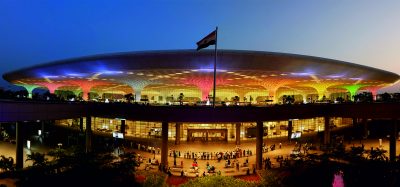

Airports Council International (ACI) World has launched its Airport Economics Report and Key Performance Indicators (KPIs) for the financial year of 2020, providing the first in-depth global breakdown of airports’ financial activities during the first year of the pandemic.

The annual ACI Airport Economics Report presents an in-depth global analysis of airport industry revenues by source, costs, and related trends across the globe and over time, while the Airport Key Performance Indicators (KPIs) provide insight into areas such as financial and employee performance, fixed-asset productivity, and airport operations through detailed statistics.

Impact on revenues

According to the latest Airport Economics Report and KPIs, airports’ primary revenue sources—aeronautical and non-aeronautical (commercial) activities—declined sharply in 2020.

When looking at individual aeronautical revenue sources, revenues from passenger-related charges saw the largest declines (-65 per cent) in tandem with the historic collapse in traffic. Although airports supported air cargo operations amidst the pandemic, revenues from landing charges plummeted as well (-42 per cent).

Although all non-aeronautical sources declined in 2020 compared with 2019, those directly affected by passenger volume suffered the most, such as retail concessions (-65.2 per cent).

The airport industry remains asset intensive. As a result, the airport cost structure is characterised by predominantly high fixed costs necessary for maintaining and operating the infrastructure components of airports, such as runways, taxiways, aprons, parking stands, and terminal buildings.

Even though total airport costs dropped in absolute terms, costs on a per-passenger basis increased 91.8 per cent. This is the result of passenger traffic plummeting as compared to a fixed cost base. With many airports freezing or waving certain aeronautical charges in tandem with rent relief on the commercial side of the business, unit revenues were significantly lower than unit costs during 2020.

Airport charges vital for sustained recovery

Considering the financial impact of the pandemic on the airport business, revenues from airport charges remain the lifeblood of airports in recovering costs—vital for airports’ recovery, the investment in infrastructure needed to meet future demand, and for the ultimate benefit of the travelling public and local communities. Disproportionate regulatory regimes that hinder flexibility in setting the right level of charges represent an additional impediment to airport development.

“The entire aviation sector has been financially affected by the pandemic and we must all work together to ensure that all parts of the ecosystem recover sustainably,” said ACI World Director General, Luis Felipe de Oliveira. “For airports, this means financing unavoidable high fixed costs that come with being infrastructure-intensive businesses—through more efficient charging system.

“As advocated in the ACI Policy Brief on the modernisation of global policy frameworks on airport charges, airport charging policies should be focused on market needs and signals and the best way forward—for the benefit of the travelling public, local communities, and the recovery of the entire aviation ecosystem—is through commercial agreements between airports and airlines.

“In addition, airports must adjust their non-aeronautical business strategies to reflect the new playing field. As the airport business rebuilds, we have an opportunity to strengthen these key revenue streams by understanding current trends and anticipating those on the horizon. Not only does this include wider societal and technological shifts, but also a deeper understanding of the behaviours and needs of passengers.”

Recognising the important role airport commercial revenues will have in the long-term sustained recovery of the airport industry and the entire aviation ecosystem, ACI has launched a new series of guidance material to strengthen airports’ non-aeronautical revenue and activities. Topics covered, or to be covered, include airport ground access services, concession agreements, duty free, digitalisation, food and beverage, and sustainability.

Related topics

Aeronautical revenue, COVID-19, Digital transformation, Non-aeronautical revenue, Passenger volumes, Retail