Positive passenger recovery in 2021 despite impact of Omicron variant

- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Posted: 26 January 2022 | International Airport Review | No comments yet

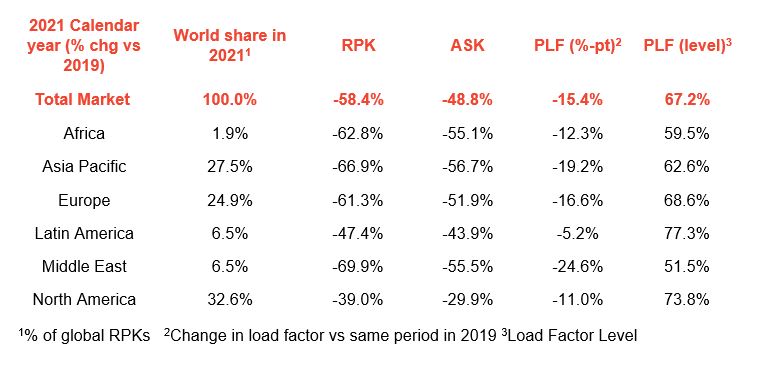

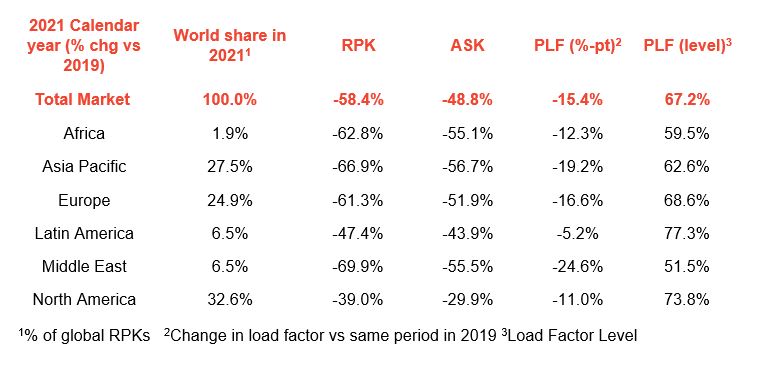

According to the International Air Transport Association, global passenger traffic results for 2021 fell by 58.4 per cent compared to 2019, but showed significant improvement compared to 2020 figures.

The International Air Transport Association (IATA) announced full-year global passenger traffic results for 2021 showing that demand (revenue passenger km or RPKs) fell by 58.4 per cent compared to the full year of 2019. This represented an improvement compared to 2020, when full year RPKs were down 65.8 per cent versus 2019.

Because comparisons between 2021 and 2020 results are distorted by the extraordinary impact of COVID-19, unless otherwise noted all comparisons are to the respective 2019 period, which followed a normal demand pattern.

- International passenger demand in 2021 was 75.5 per cent below 2019 levels. Capacity, (measured in available seat kilometers or ASKs) declined 65.3 per cent and load factor fell 24.0 percentage points to 58.0 per cent

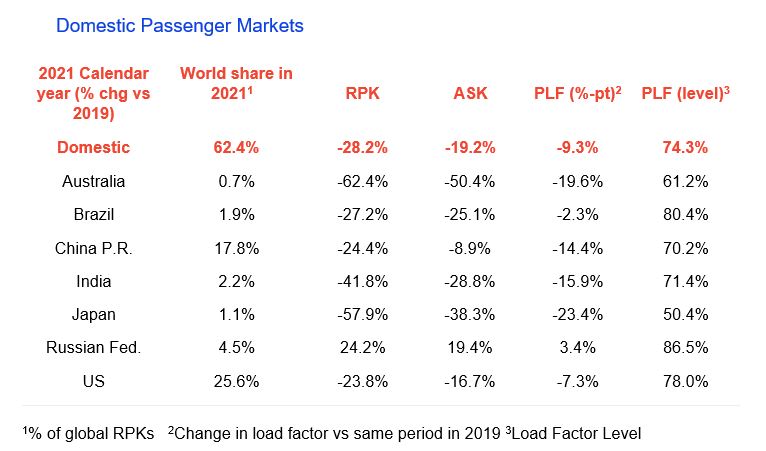

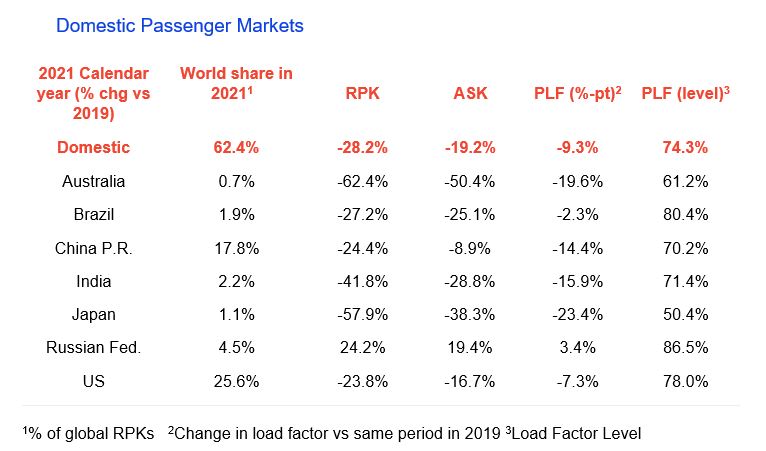

- Domestic demand in 2021 was down 28.2 per cent compared to 2019. Capacity contracted by 19.2 per cent and load factor dropped 9.3 percentage points to 74.3 per cent

- Total traffic for the month of December 2021 was 45.1 per cent below the same month in 2019, improved from the 47.0 per cent contraction in November 2021, as monthly demand continued to recover despite concerns over Omicron. Capacity was down 37.6 per cent and load factor fell 9.8 percentage points to 72.3 per cent

Impact of Omicron measures

Omicron travel restrictions slowed the recovery in international demand by about two weeks in December 2021. International demand has been recovering at a pace of about four percentage points/month compared to 2019. Without Omicron, we would have expected international demand for the month of December to improve to around 56.5 per cent below 2019 levels. Instead, volumes rose marginally to 58.4 per cent below 2019 from -60.5 per cent in November 2021.

Willie Walsh, IATA’s Director General commented: “Overall travel demand strengthened in 2021. That trend continued into December 2021 despite travel restrictions in the face of Omicron. That says a lot about the strength of passenger confidence and the desire to travel. The challenge for 2022 is to reinforce that confidence by normalising travel. While international travel remains far from normal in many parts of the world, there is momentum in the right direction. Last week (17 to 23 January 2022), France and Switzerland announced significant easing of measures. On 25 January 2022, the UK removed all testing requirements for vaccinated travellers. We hope others will follow their important lead, particularly in Asia where several key markets remain in virtual isolation.”

Credit: IATA

International Passenger Markets

- Asia to Pacific airlines’ full-year international traffic plunged 93.2 per cent in 2021 compared to 2019, which was the deepest decline for any region. It fell 87.5 per cent in the month of December 2021, a bit better than the 89.8 per cent decline in November 2021. Full year capacity was down 84.9 per cent compared to 2019. Load factor fell 44.3 percentage points to 36.5 per cent

- European carriers saw a 67.6 per cent traffic decline in 2021 versus 2019. Capacity fell 57.4 per cent and load factor decreased 20.6 percentage points to 65.0 per cent. For the month of December 2021, traffic slid 41.5 per cent compared to December 2019, an improvement over the 43.5 per cent year-to-year decline in November 2021

- Middle Eastern airlines’ annual passenger volumes in 2021 were 71.6 per cent below 2019. Annual capacity fell 57.7 per cent and load factor dropped 25.1 percentage points to 51.1 per cent. December 2021’s traffic was down 51.2 per cent compared to December 2019, a solid pick-up from a 54.3 per cent drop in November

- North American airlines’ full year traffic fell 65.6 per cent compared to 2019. Capacity dropped 52.0 per cent, and load factor sank 23.8 percentage points to 60.2 per cent. December 2021 demand was down 41.7 per cent compared to the same month a year-ago, a pick-up over a 44.6 per cent drop in November 2021

- Latin American airlines had a 66.9 per cent full year traffic decline compared to 2019. Capacity fell 62.2 per cent and load factor dropped 10.2 percentage points to 72.6 per cent, the highest among regions. Traffic fell 40.4 per cent for the month of December 2021 compared to December 2019, significantly bettering the 47.3 per cent decline in November

- African airlines’ international traffic fell 65.2 per cent last year (2021) compared to 2019, which was the best performance among regions. Capacity dropped 56.7 per cent, and load factor sank 14.1 percentage points to 57.3 per cent. Demand for the month of December was 60.5 per cent below the year-ago period, a deterioration from the 56.5 per cent decline in November, owing to the impact of government travel restrictions in response to Omicron.

Credit: IATA

- China’s domestic passenger traffic fell 24.4 per cent in 2021 compared to 2019. It was down 39.6 per cent for the month of December 2021 versus December 2019, which was an improvement compared to a 50.9 per cent decline in November 2021

- Russia’s domestic traffic rose 24.2 per cent for the full year, and 23.2 per cent for the month of December 2021, an acceleration over the 17.5 per cent rise in November. Russia was the only market to see growth in RPKs in 2021 compared to 2019.

The Bottom Line

“As COVID-19 continues to evolve from the pandemic to endemic stage, it is past time for governments to evolve their responses away from travel restrictions that repeatedly have been shown to be ineffective in preventing the spread of the disease, but which inflict enormous harm on lives and economies. A New Year’s resolution for governments should be to focus on building population immunity and stop placing travel barriers in the way of a return to normality,” added Walsh.

Related topics

Air traffic control/management (ATC/ATM), Airside operations, COVID-19, Passenger experience and seamless travel, Passenger volumes, Terminal operations