Aviation anticipates further disruption to passenger traffic due to Omicron

- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Posted: 12 January 2022 | International Airport Review | No comments yet

According to the International Air Transport Association, global passenger traffic improved in November 2021, however Omicron restrictions are likely to impact air travel in the coming months.

The International Air Transport Association (IATA) announced that the recovery in air travel continued in November 2021, prior to the emergence of Omicron variant. International demand sustained its steady upward trend as more markets reopened. Domestic traffic, however, weakened, largely owing to strengthened travel restrictions in China.

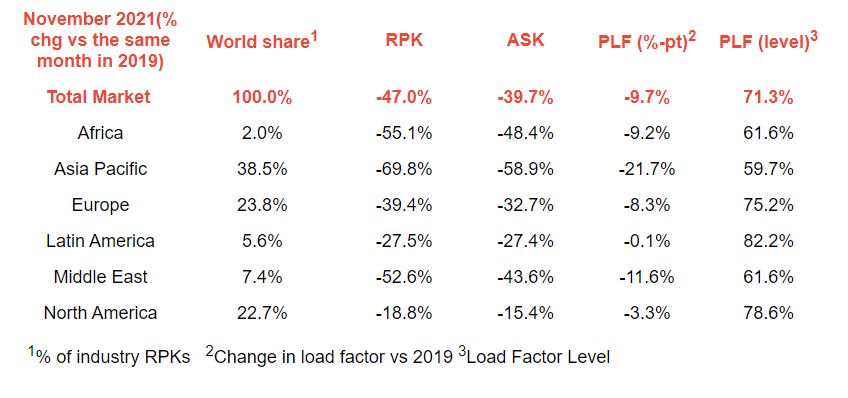

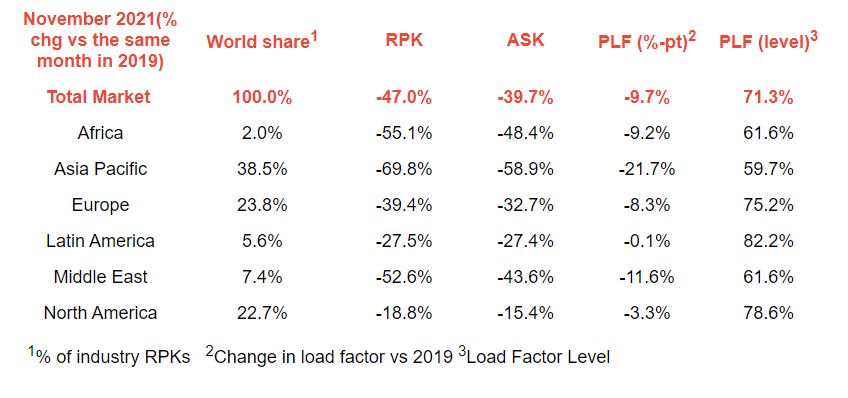

Because comparisons between 2021 and 2020 monthly results are distorted by the extraordinary impact of COVID-19, unless otherwise noted all comparisons are to November 2019, which followed a normal demand pattern:

- Total demand for air travel in November 2021 (measured in revenue passenger-kilometers or RPKs) was down 47.0 per cent compared to November 2019. This marked an uptick compared to October’s 48.9 per cent contraction from October 2019

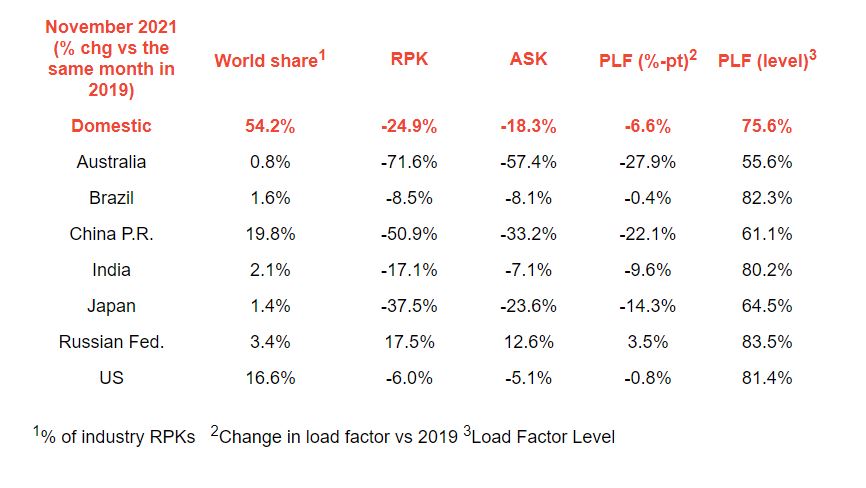

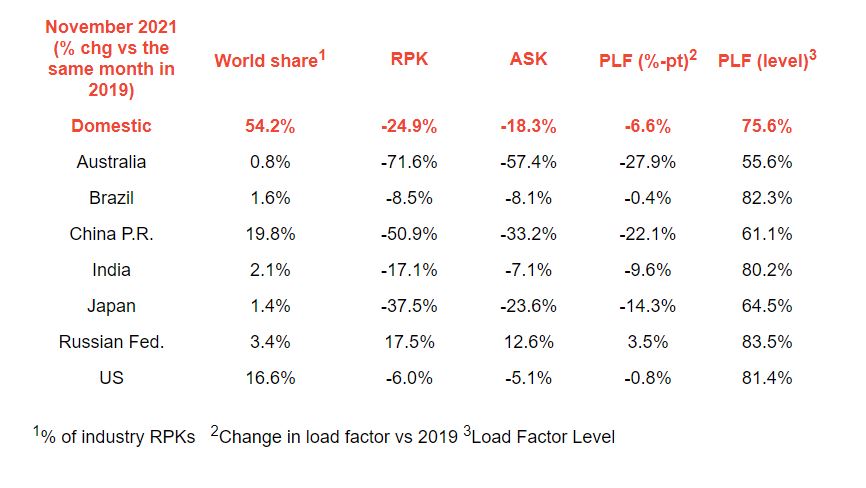

- Domestic air travel deteriorated slightly in November after two consecutive monthly improvements. Domestic RPKs fell by 24.9 per cent versus 2019 compared with a 21.3 per cent decline in October. Primarily this was driven by China, where traffic fell 50.9 per cent compared to 2019, after several cities introduced stricter travel restrictions to contain (pre-Omicron) COVID-19 outbreaks

- International passenger demand in November was 60.5 per cent below November 2019, bettering the 64.8 per cent decline recorded in October.

“The recovery in air traffic continued in November,” commented Willie Walsh, IATA’s Director General. “Unfortunately, governments over-reacted to the emergence of the Omicron variant at the close of the month and resorted to the tried-and-failed methods of border closures, excessive testing of travellers and quarantine to slow the spread. Not surprisingly, international ticket sales made in December and early January fell sharply compared to 2019, suggesting a more difficult first quarter than had been expected. If the experience of the last 22 months has shown anything, it is that there is little to no correlation between the introduction of travel restrictions and preventing transmission of the virus across borders. These measures place a heavy burden on lives and livelihoods. If experience is the best teacher, let us hope that governments pay more attention as we begin the New Year (2022).”

Credit: International Air Transport Association (IATA)

International passenger markets

- European carriers’ November international traffic declined 43.7 per cent versus November 2019, much improved compared to the 49.4 per cent decrease in October versus the same month in 2019. Capacity dropped 36.3 per cent and load factor fell 9.7 percentage points to 74.3 per cent

- Asia-Pacific airlines saw their November international traffic fall 89.5 per cent compared to November 2019, slightly improved from the 92.0 per cent drop registered in October 2021 versus October 2019. Capacity dropped 80.0 per cent and the load factor was down 37.8 percentage points to 42.2 per cent, the lowest among regions

- Middle Eastern airlines had a 54.4 per cent demand drop in November compared to November 2019, well up compared to the 60.9 per cent decrease in October, versus the same month in 2019. Capacity declined 45.5 per cent, and load factor slipped 11.9 percentage points to 61.3 per cent

- North American carriers experienced a 44.8 per cent traffic drop in November versus the 2019 period, significantly improved over the 56.7 per cent decline in October compared to October 2019. Capacity dropped 35.6 per cent, and load factor fell 11.6 percentage points to 69.6 per cent

- Latin American airlines saw a 47.2 per cent drop in November traffic, compared to the same month in 2019, a marked upturn over the 54.6 per cent decline in October compared to October 2019. November capacity fell 46.6 per cent and load factor dropped 0.9 percentage points to 81.3 per cent, which was the highest load factor among the regions for the 14th consecutive month

- African airlines’ traffic fell 56.8 per cent in November versus two years’ ago, improved over the 59.8 per cent decline in October compared to October 2019. November capacity was down 49.6 per cent and load factor declined 10.1 percentage points to 60.3 per cent.

Credit: International Air Transport Association (IATA)

Domestic passenger markets

- Australia remained at the bottom of the domestic RPK chart for the fifth consecutive month with RPKs 71.6 per cent below 2019, albeit this was improved from a 78.5 per cent decline in October, owing to the reopening of some internal borders.

- U.S. domestic traffic was down just 6.0 per cent compared November 2019 – improved from an 11.1 per cent fall in October, thanks in part to strong Thanksgiving holiday traffic.