Latest EUROCONTROL data reveals aviation’s COVID summer recovery

Posted: 10 September 2021 | International Airport Review | No comments yet

EUROCONTROL’s latest data snapshot reports the aviation industry’s COVID-19 recovery, this summer, with flights back to 70 per cent of 2019 levels within the EU.

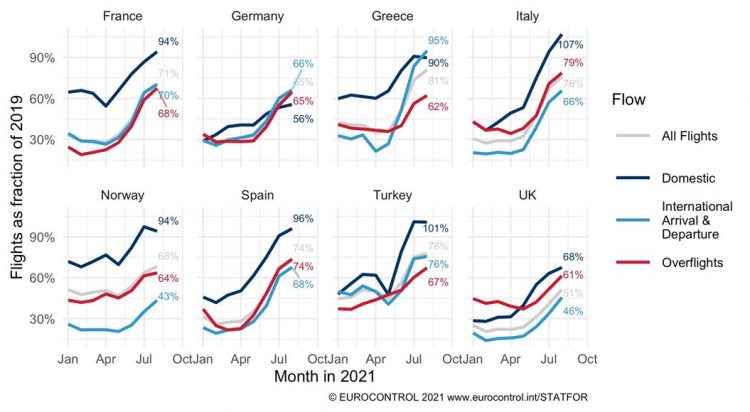

In August 2021, flights were back to 71 per cent of 2019 levels across EU. This average, however, conceals a wide variation between countries and between different traffic flows for each country. The graphic illustrates this variation, taking examples from some of EU’s larger aviation markets.

EUROCONTROL noted in a data snapshot in March that domestic flights were holding up better during the COVID-19 pandemic than international flights. This summer, that trend has continued. Turkey, indeed, exceeded 2019 domestic flight counts already in July. Then Italy beat that in August, reaching 107 per cent of 2019, with France, Greece, Norway, and Spain all at 90 per cent or more. In the graph, German domestic flights stand out by being overtaken by other flows.

International arrivals and departures include long- and short-haul, and both passenger and cargo flights. COVID-19 passenger travel restrictions have mostly affected international passenger flights, and this is reflected in the relatively low figures for international flights (as compared to domestic ones). From the graph, UK and Norway remain particularly weak on this flow: still less than half of 2019 levels. Key holiday destinations, on the other hand, saw a rapid recovery in July and even more in August.

Overflights, not touching an airport in the country, often make a significant contribution to revenues of a country’s air navigation service provider. The UK has the weakest overflights of these eight countries, with both Ireland and North Atlantic, which make up most of this flow, slow to recover. Italy and Spain are much stronger, with a strong acceleration starting in July; for example, Italy picked up flights from France and Switzerland to Greece, both of which are already above 2019 counts.

The International Airport Summit is open for registration!

Date: 19 – 20 November 2025

Location: JW Marriott Hotel Berlin

At our flagship event of the year, we will dive into the future of airport operations, with expert-led sessions on passenger experience, innovative smart technologies, baggage handling, airside operations, data, security, and sustainability.

This is where global airport leaders come together to share insights, challenges, and real-world solutions.

Limited complimentary passes are available for eligible professionals – first come, first served!

Related topics

Aeronautical revenue, Air traffic control/management (ATC/ATM), Airside operations, COVID-19, Passenger volumes