IATA July passenger traffic report but remains below pre-COVID-19 levels

- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Posted: 8 September 2021 | International Airport Review | No comments yet

The International Air Transport Association’s July 2021 report shows a growth in international and domestic travel demand, although figures remain below pre-COVID-19 results.

The International Air Transport Association (IATA) announced that both international and domestic travel demand showed significant momentum in July 2021 compared to June, but demand remained far below pre-COVID-19 levels. Extensive government-imposed travel restrictions continue to delay recovery in international markets.

Due to comparisons between 2021 and 2020 monthly results are distorted by the extraordinary impact of COVID-19, unless otherwise noted all comparisons are to July 2019, which followed a normal demand pattern.

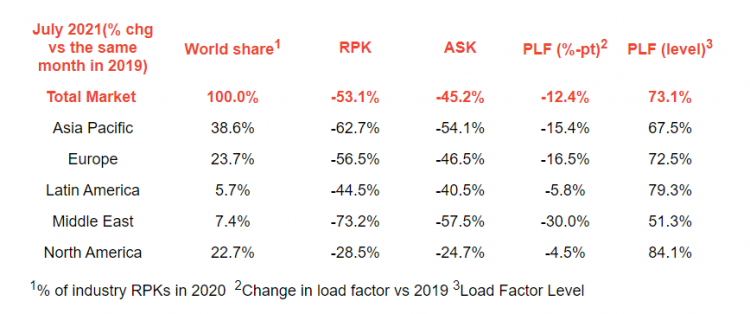

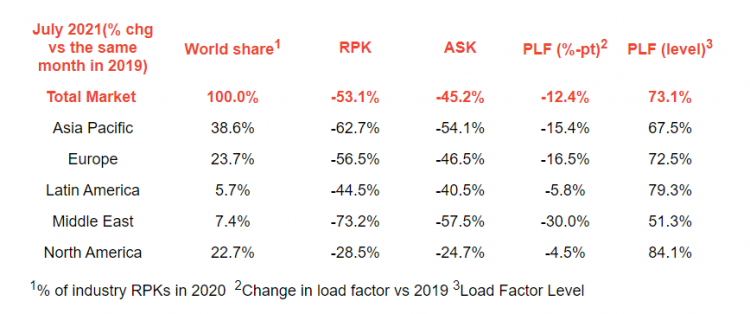

- Total demand for air travel in July 2021 (measured in revenue passenger km or RPKs) was down 53.1 per cent compared to July 2019. This is a significant improvement from June when demand was 60 per cent below June 2019 levels.

- International passenger demand in July was 73.6 per cent below July 2019, bettering the 80.9 per cent decline recorded in June 2021 versus two years ago. All regions showed improvement and North American airlines posted the smallest decline in international RPKs (July traffic data from Africa was not available).

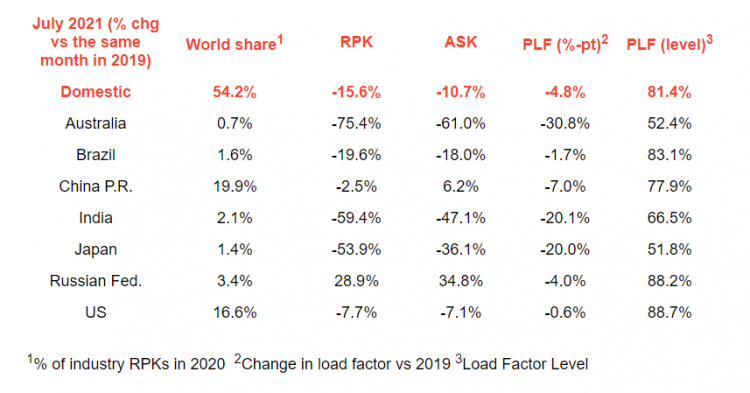

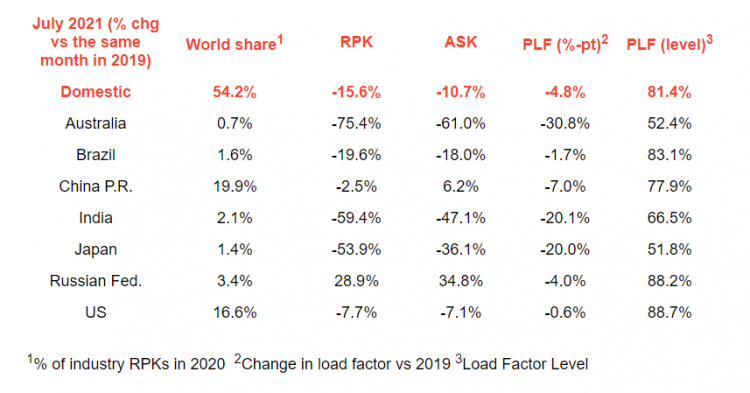

- Total domestic demand was down 15.6 per cent versus pre-crisis levels (July 2019), compared to the 22.1 per cent decline recorded in June over June 2019. Russia posted the best result for another month, with RPKs up 28.9 per cent vs. July 2019.

Willie Walsh, IATA’s Director General said: “July results reflect people’s eagerness to travel during the Northern Hemisphere summer. Domestic traffic was back to 85 per cent of pre-COVID-19 levels, but international demand has only recovered just over a quarter of 2019 volumes. The problem is border control measures. Government decisions are not being driven by data, particularly with respect to the efficacy of vaccines. People travelled where they could, and that was primarily in domestic markets. A recovery of international travel needs governments to restore the freedom to travel. At a minimum, vaccinated travellers should not face restrictions. That would go a long way to reconnecting the world and reviving the travel and tourism sectors.”

Credit: IATA

International passenger markets

- EU carriers saw their July international traffic decline 64.2 per cent versus July 2019, significantly bettering the 77.0 per cent decrease in June compared to the same month in 2019. Capacity dropped 53.8 per cent and load factor fell 19.9 percentage points to 69.0 per cent.

- Asia-Pacific airlines’ July international traffic fell 94.2 per cent compared to July 2019, barely improved over the 94.7 per cent drop registered in June 2021 versus June 2019, as the region continues to have the strictest border control measures. Capacity dropped 86.0 per cent and the load factor was down 48.2 percentage points to 34.3 per cent, by far the lowest among regions.

- Middle Eastern airlines posted a 74.5 per cent demand drop in July compared to July 2019, surpassing the 79.2 per cent decrease in June, versus the same month in 2019. Capacity declined 59.5 per cent, and load factor deteriorated 30.1 percentage points to 51.3 per cent.

- North American carriers’ July demand fell 62.1 per cent compared to the 2019 period, much improved on the 69.4 per cent decline in June versus two years ago. Capacity sank 52.0 per cent, and load factor dipped 18.6 percentage points to 69.3 per cent.

- Latin American airlines saw a 66.3 per cent drop in July traffic, compared to the same month in 2019, improved over the 69.8 per cent decline in June compared to June 2019. July capacity fell 60.5 per cent and load factor dropped 12.6 percentage points to 72.9 per cent, which was the highest load factor among the regions for the ninth consecutive month.

Domestic passenger markets

Credit: IATA

- Australia’s domestic traffic sank further from a 51.4 per cent decline in June versus the same month in 2019, to a 75.4 per cent decline in July versus two years ago, amid stricter domestic lockdowns in response to a spike in the Delta variant.

- US domestic traffic continued to recover in July, and was down just 7.7 per cent compared to July 2019, improved from a 14.0 per cent decline in June versus June 2019.

The bottom line

“As the Northern Hemisphere summer travel season draws to a close, too many governments missed the opportunity to apply a risk-based approach to managing their borders,” further added Walsh. “The growing number of fully vaccinated travellers and the prevalence of testing provided the chance to restore international connectivity and bring much needed relief to economies that are heavily reliant on travel and tourism. Instead, governments continued to behave as if it was the summer of 2020. Economies and the labour force will pay the price for decisions that were made not based on science, but on political expediency. Governments have rightly urged their populations to be vaccinated; now governments need to have confidence in the benefits of vaccinations, including the freedom to travel.”

Related topics

Airside operations, COVID-19, Passenger experience and seamless travel, Passenger volumes, Terminal operations

Related organisations

Related regions

Asia Pacific and Oceania, Central and South America, Europe, Middle East, North America