Air Cargo resumes fragile recovery

- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Posted: 4 December 2013 | IATA | No comments yet

The International Air Transport Association released figures showing a small improvement in air freight growth in October…

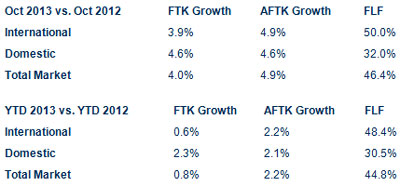

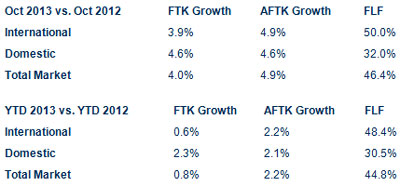

The International Air Transport Association (IATA) released figures showing a small improvement in air freight growth in October. Compared to October 2012, global freight tonne kilometers (FTK) grew 4.0%, with growth in all regions except Africa.

The gradual expansion continues a trend that began in the third quarter as air freight markets have responded to better economic confidence and improved consumer demand. Performance varies significantly by region, however. Middle East carriers reported the most impressive growth at 12.3%. European and North American airlines reported growth of 4.4% and 3.7% respectively which is below the long-term cargo growth trend of 5%-6%. Asia-Pacific carriers grew by a marginal but significant 2.0%, finally countering the decline over most of 2013. The pick-up in Chinese growth and trade volumes across the region indicates that Asia-Pacific, which is comfortably the largest air freight region by market share, is potentially poised for continued expansion.

“Since mid-year we have seen modest but sustained growth in cargo fed by stronger business confidence and improving trade flows. Air cargo is still a very tough business. Matching capacity to demand has been difficult in an environment where passenger traffic is growing more robustly. There is some evidence that the fall in load factors has stabilized, but yields remain under pressure,” said Tony Tyler, IATA’s Director General and CEO.

The average load factor for October was 46.4%, which is an improvement on the year-to-date load factor of 44.8%. This is still several percentage points below 2010 when they peaked at over 50%.

All regions but Africa grew in October 2013 compared to a year ago. The strongest growth was in the Middle East, but Europe also showed healthy improvement. Europe and the Middle East combined have carried three quarters of the cargo increase over the past six months.

- Asia-Pacific carriers’ traffic grew 2.0%, with capacity up 4.1%. Asian cargo volumes benefited from a resurgence in trade across the region, fueled by a stronger Chinese economy where manufacturing activity hit a 7-month-high. Both export and import volumes rose strongly in emerging Asian markets, reversing a mid-year decline. This bodes well for further growth in air freight in the months to come.

- European airlines expanded FTKs by 4.4%, maintaining the steady improvement in recent months, as the continent continued to emerge from recession. The recovery remains fragile, however, with growth in Q3 slowing to 0.1% from 0.3% in Q2. Weak growth for the remainder of the year should support a further modest expansion in European FTKs. Capacity grew by just 3.6%.

- North American carriers rebounded from their September contraction to record a solid rise of 3.7%, despite the 17-day federal government shutdown. Although activity in the US manufacturing sector has been increasing for the past three months, the expansion is much slower than at the start of the year. Given that year-to-date there has been a decrease of 0.9%, it is clear that the outlook remains difficult.

- Middle Eastern carriers grew 12.3% compared to a year ago. After the year-on-year slowdown in September caused by Ramadan, freight growth in the Middle East resumed its strong upward trajectory. Capacity was well-matched to demand, with an increase of 12.1%.

- Latin American airlines grew by 1.5% year-on-year, a slowdown from the 3.6% rate recorded in September. However, the year-to-date growth rate (3.6%) remains the second-fastest of all regions, supported by a 10% increase in regional trade volumes. Competition from European and US carriers on routes from Latin America, however, does impact on carriers from the region.

- African carriers experienced the only decline in October compared to October of last year (-2.7%). Growth in air freight carried by African airlines has seen a slow decline for several months. Although trade volumes for the region continue to increase, competition on important trade routes is strong and lack of adequate infrastructure and political stability continue to hinder growth potential. Weak demand coupled with continued capacity expansion has placed load factors under further pressure, falling 3.5 percentage points compared to a year ago.

Trade Talks Key to Unlocking Growth

Delegates at the World Trade Organization meet in Bali this week to attempt to re-start the Doha round of trade liberalization negotiations. It is crucial that governments make progress to unblock the barriers to global trade. Since the start of the financial crisis, some 500 pieces of protectionist legislation have been enacted round the world, but there is strong evidence that liberalization measures help to increase trade volumes.

“Governments looking for ‘quick wins’ to facilitate improved trade flows should check that they have ratified the Montreal Convention 99. This treaty provides the legal framework for paperless cargo shipments, dispensing with up to 30 pieces of paper and leading to improvements in efficiency, speed, and cargo security. At present, 88 states have not signed MC99 into law. These include countries in some of the fastest-growing air cargo markets, such as Africa and South-East Asia. At its recent 38th Assembly, International Civil Aviation Organization members passed a resolution urging states that have not yet ratified MC99 to do so. The air cargo industry wholeheartedly supports that resolution and IATA and the International Federation of Freight Forwarders Associations(FIATA) will be in Bali this week to reinforce that message,” said Tyler.