Global cargo growth stabilizes – regional variances remain

- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Posted: 30 October 2013 | The International Air Transport Association | No comments yet

Overall air cargo volumes are at a 25-month high, and steady increases in the size of the market since April have been supported…

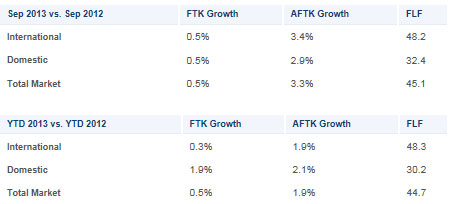

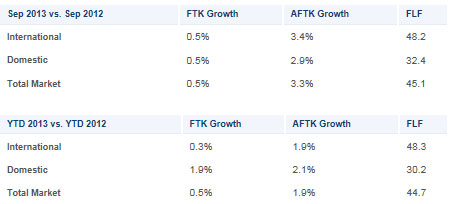

The International Air Transport Association (IATA) released figures showing cargo growth stabilizing in September following recent months of slow but steady growth. Freight Tonne Kilometers (FTK) grew by 0.5% year-on-year. While this is slower that the 3.4% growth recorded for August, overall air cargo volumes are at a 25-month high, and steady increases in the size of the market since April have been supported by improvements in business conditions. The slow-but-steady global growth picture is colored by significant regional variation. Asia-Pacific airlines experienced a 3.1% fall in cargo activity compared to last September whereas carriers in the Middle East reported 9.9% growth.

“The story behind September’s performance is regional. The leveling-off of global volumes was a result of the growth rate in Europe and the Middle East moderating after recent acceleration, while Asia-Pacific airlines saw a deepening of the market weakness,” said Tony Tyler, IATA’s Director General and CEO.

“At a global level, the September results are aligned with our expectations for an improvement towards the end of the year. All indicators still point to strengthening business confidence as we approach the final quarter. That’s cause for cautious optimism. But the persistent cargo weakness when compared to the strength of passenger markets is a signal for the industry to work at improving its value proposition with programs such as e-freight,” Tyler said.

Regional Analysis

September performance was heavily influenced by a moderation of freight growth in the Middle East, which has carried much of the rises of recent months. Asia-Pacific freight continued to decline, while Europe demonstrated a modest rise.

Asia-Pacific carriers continue to see weakness in air freight demand. FTKs fell 3.1% in September compared to a year ago, deepening the contraction so far this year to 2.1%. A positive sign for the future is that the pressure from regional economic weakness appears to be easing. In particular, China’s GDP growth has picked up slightly. Capacity grew 1.3% leaving load factors at 55.5%.

European carriers grew 1.4% in September year-on-year, down on August’s robust 3.4% rise. Benefiting from the improvement in the European economy, airlines in the region have carried about 30% of the rise in global volumes since the second quarter, and FTKs are now the highest they have been since mid-2011. The load factor, however, fell to 46.0% as capacity grew 2.6%.

North American airlines grew just 0.9% in September compared to a year ago, but this does buck the declining trend seen so far this year (-1.1%). Going forward, US prospects are uncertain; while business confidence started to improve in Q3, it remains below the average seen at the start of the year, and the impact of the US government shutdown in October is not yet clear.

Middle East carriers recorded strong growth in September, up 9.9%, but this is slightly below the average performance so far this year (12.3%). However, the underlying trends for the region are strong. Improving conditions in advanced economies should boost trade through the Gulf hubs, and trade volumes in the Middle East have shown solid momentum in recent months.

Latin American airlines continue to see solid growth in air freight volumes, expanding 3.9% year-on-year. The region has seen the strongest increase in trade this year (up 8% in August compared to the start of 2013) supporting the continued expansion in air freight demand. Latin American carriers were also the only region to increase load factors in September compared to a year ago, though the level overall is still below the global average.

African carriers’ FTKs fell 0.8% in September compared to a year ago, although for the year as a whole they are still in positive territory (1.1%). This is in line with recent performance: African freight growth has tailed off after a strong start to the year. Capacity rose by 11.2%, the second fastest of any region, which pushed their load factor down to just 26.3%, almost 20 percentage points lower than the global average (45.1%).

View September air freight results (pdf)