Brexit: Sleep-walking towards disaster for aviation | Chris Chalk

- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Posted: 15 June 2017 | Chris Chalk | Mott MacDonald | 1 comment

Chris Chalk*, speaking as a member of the British Aviation Group (BAG), offers an analysis of the potentially devastating impact of Brexit on both the UK and the European aviation networks.

Brexit will not be neutral and will not result in status quo. It constitutes an “exceptional situation” which will have human, economic, financial, legal and political consequences…. We must be mindful that the absence of agreement with the UK would have – for both sides – even more grave consequences.

Michel Barnier – EU Chief Negotiator for BREXIT at the EU Committee of the Regions

Whilst we can all debate the rights and wrongs of the referendum that led to Brexit we have been dealt a card that the aviation industry was neither expecting nor prepared for. Modern democracy has cast aside the political norms demanding change on the basis that it must be better than under the current political elite; Brexit, Trump, France and who is next. Our mature democracies have maintained a degree of stability but going forward those institutions who build barricades around themselves to protect the status quo will eventually be eclipsed into irrelevance.

The institutions that are involved in Brexit over the next 18 months have every opportunity to fail. Such failure could set aviation back not just across Europe but around the globe by about 20 years.

A democracy is nothing more than mob rule, where fifty-one percent of the people take away the rights of the other forty-nine.

Thomas Jefferson

Rules are only good when market tested and Article 50 creates a market test for the EU that was probably never contemplated when the rules were drawn up. The two-year deadline, which includes the set up and report back, leaves little over 12 months to work out the means of exit and future relationships across the full bandwidth of decades of intertwining of relationships and laws. The EU is not known for its efficiency both due to it being answerable to 27 member states but also in the depth of bureaucracy that has grown year on year despite the global recession.

The UK is saying that no deal is better than a bad deal and Germany is saying that the UK is no longer a reliable partner. A €100bn exit fee before discussing new trade relationships against an integrated deal or no deal.

“Pay or face the consequences”.

Not exactly a strong start.

The recent UK General Election is creating a blancmange of political leadership.

The EU’s position of “an exit without a shopping list of benefits” suggests that getting some form of integration of the aviation sector that many in the industry would like to see is going to be a challenge.

This is not eased due to differing opinions amongst aviation stakeholders.

Let’s unpack what this means for aviation and aerospace. It is perhaps worth noting that four of the five priorities set by the EU affect aviation to a greater or lesser extent.

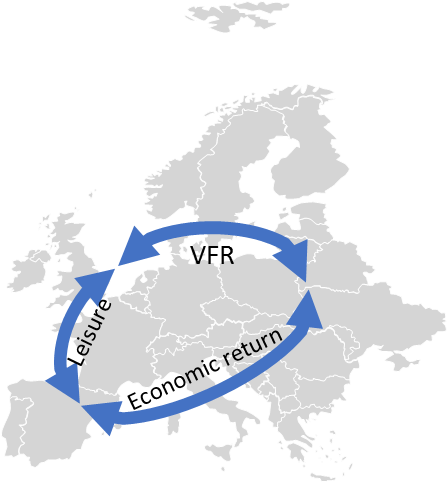

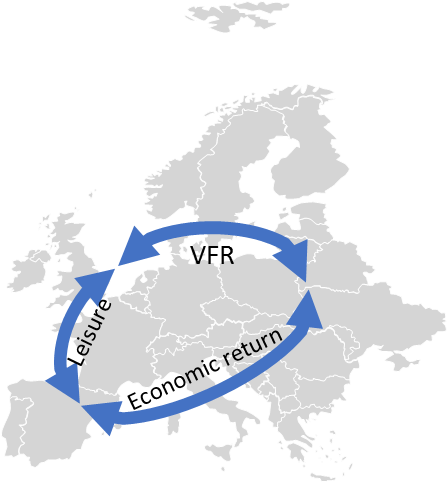

- The status & rights of UK citizens in the EU and of EU citizens in the UK; employment in the UK service economy and generator of significant flights across Europe for Visiting Friends and Relatives (VFR) traffic

- Disruptions in the provision/circulation of goods to the UK impacting for value chains. The European supply chain would be disadvantaged against the US and Asia

- The reintroduction of customs controls, which would slowdown trade; and

- Aviation as withdrawal from the ECAA would create very serious disruptions for air traffic to/from the UK.

Dislocation to movement

The UK is largely an economy fuelled by human resources, with one of the few advanced economies bucking the trend of demographic shrinkage. The net migration over the years has developed a strong inbound diaspora from across many of the worlds geographies including the Caribbean, the India sub-continent and more recently across Europe.

The UK is largely an economy fuelled by human resources

The European diaspora, coupled with the development of low cost carriers, has helped to generate unprecedented aviation demand and connectivity from regional communities with significant redistribution of wealth.

Constraint to this inbound resource into the UK will not only negatively affect the regional economies, particularly in central Europe, but the cost of equivalent services from within the UK will fuel inflation and further currency devaluation.

Constraint to this inbound resource into the UK will not only negatively affect the regional economies, particularly in central Europe, but the cost of equivalent services from within the UK will fuel inflation and further currency devaluation.

Such weakness will reduce the affordability of European products, particularly tourism into southern Europe. Constraint to demand in southern Europe will place greater demands on the 27 member states to maintain investment in economically disadvantaged parts of Europe. Reduction in demand not only reduces routes but also increases unit costs to airports and, eventually, charges. Increased charges will further dampen demand.

Membership of the European Common Aviation Area (ECAA)

Growth of European air traffic in the past 20 years has been driven by the low cost carriers through the introduction of the EU Third Aviation Liberalisation Package. This has led to more choice, more competition, increased efficiency and lower fares making air travel more accessible to a wider population. The ability of EU airlines to have a single Airline Operational Certificate across Europe increases flexibility that in turn leads to higher utilisation and lower operational costs.

Airlines pass on these savings to their passengers through lower fares, which in turn stimulates demand that down the line increases demand for services and products. Lack of access for the UK to the ECAA is likely to have a direct impact not only on three of the five largest airlines in Europe but also on a significant number of airports across Europe as routes are pulled and charges increased.

Roll back of bilateral agreements

There are broader and more immediate issues: Firstly, a roll-back of bilateral agreements would cause chaos in particular where there are none. There is significant concern over the legal validity of air tickets sold after 29th March 2019 due to the lack of air traffic rights. The EU/US open skies agreement was largely around access for US carriers to Heathrow; roll that back and we would be using the Bermuda II agreement with just two UK and two US carriers having access to Heathrow, that would mean Delta losing access to Heathrow.

That would mean Delta losing access to Heathrow

There would also be significant restriction in flights due to restrictions on routes and seats. Norwegian and Ryanair would need to establish UK AOCs, and EasyJet, an EU AOC. More easily said than done as the AOC depends on the ownership of the airline, for example, Ryanair would struggle to present an EU ownership and Norwegian and UK ownership model. Disruption to carriers leads to reallocation of aircraft.

As for IAG – how does that disaggregate with Iberia, Aer Lingus, British Airways and Vueling? Airlines are already planning their initial schedules for 2019, the year of Brexit, and no one has the least idea which flights can be flown and what seats can be sold.

Refocus of Low Cost Carriers

Whilst disruption to the UK market may be seen as an opportunity for the EU major carriers of Lufthansa Star Alliance and KLM Air France, this will not be the case.

Three of the five largest air carriers in Europe have their main base in London. UK and Irish carriers have re-structured to coexist with Ryanair and EasyJet, the two largest carriers in Europe and in order for these carriers to grow their focus would need to move to mainland Europe. Focus would be on the areas of wealth and volume, i.e. Germany and France. Whilst IAG has undergone significant restructuring of its cost base, neither Lufthansa Star Alliance and KLM Air France have fully swallowed the bitter pill of 21st century efficiency leaving them to be a soft underbelly for attack of their core markets.

General impact of European Airport facilities

Whilst the UK is not part of Schengen and therefore border controls exist for those travelling between the UK and EU Member States, the current checks are focused on criminals and not on rights of abode. Changes to immigration and customs controls on EU/UK traffic, representing some 8% of overall passenger traffic, will make changes to airports inevitable through automation and technologies, reconfiguration of terminal space, equipment – all providing upside opportunities for airport designers and suppliers but at a cost to the airlines.

Employment and movement of people around Europe

A polarisation of employment could create significant dislocation for airlines, airports and the supply chain. Apart from the impact of EU nationals working and living in the UK and vice versa providing services across wide spectrums of society, there is the accompanying visiting friends and relatives traffic that quite a few smaller airports have come to depend on.

The UK economy has a high service component that has benefited from the ability to employ skilled staff from across Europe. The flexibility of employment has also enabled skilled people to follow the employment opportunities around Europe to the benefit of airports and their stakeholders. If Brexit creates employment restrictions employers will either need to endure the inflexibility of new migration rules or to grow their service and manufacturing centres outside Europe, potentially leading to labour shortages and price inflation.

Disruption to suppliers into the UK

The UK handles over 250 million passengers through its airports, ranked 4th busiest in the world, and includes Heathrow that is the busiest airport in Europe. The largest airport project in the western hemisphere, at £16bn, Heathrow Runway 3 is likely to start construction around the time of the UK exit. Other UK airports also have ambitious plans. A significant amount of the supply chain will need to be imported and this provides interesting opportunities to WBPs.

The largest airport project in the western hemisphere, at £16bn, Heathrow Runway 3 is likely to start construction around the time of the UK exit.

A hard Brexit with the potential of reversion to World Trade Organisation (WTO) rules and tariffs, together with foreign exchange uncertainties, will both increase costs for airport buyers as well as add significant costs and risks on selling into the UK supply chain. This is not just a Eurocentric matter as it would affect much of the supply chain.

Impact suppliers exporting from the UK

Reversion to WTO rules with Europe would increase costs through increased tariffs, although foreign exchange changes could offset this if sterling devalues. More of an issue will be the supply chain that relies on the UK being within the customs union and the ability to source, ship and assemble business from around the EU.

These tariff changes would also affect European suppliers who use UK components. Trade tariffs are anticipated to be a significant issue for the aerospace and automotive industries and that any bilateral trade negotiations are likely to be driven by those industries. Being outside the customs union could, of course, provide opportunities for duty and tax free sales at UK airports with significant traffic to EU destinations and for EU airports with traffic to the UK.

Broader business impact

For businesses around the world, stability and prosperity of the airlines and airports are two critical ingredients, followed by macroeconomics of growth, foreign exchange, interest rates and trade agreements. Airports and airlines need certainty of supply, both in availability and pricing from their supply chain.

For the next two years there will be huge uncertainties as to what settlement will be reached between the UK and the EU, on top of which there will be speculation on future trading relationships. In modern day parlance, this is heading for a messy divorce with lots of property and dependents to be argued over and unlikely to be clean cut.

But here’s the rub.

The elephant in the room is the European Court of Justice (ECJ) that underpins EU structures and legislation. Getting away from the civil law based ECJ to a common law based UK structure is a key issue for Brexit. The ECAA is structured under the ECJ. Can this be restructured in 12 months… sleepwalk to disaster.

Now is not the time to sit and watch what happens, but rather be a part of the evolution; working with your governments and trade bodies to maintain stability over political rhetoric. Will the outcome be a stable transition over the coming years keeping our airports safe, secure, affordable and an increasing pleasure to use?

We cannot afford to watch this time.

- If there is no deal then the UK-EU bi-laterals will role back to pre-EU.

- There are major questions as to the validity of any air tickets being sold after 29th March 2019 relating to Europe in general, in particular the UK.

- There are no preceding bi-laterals with Spain due to the Gibraltar issue. No flights equals no Spanish holidays equals severe impact on Spanish tourism economy.

- Bermuda II US/UK bilateral means Delta having no air traffic rights to Heathrow.

- Where there are historic air traffic rights the frequencies and seat capacities will be tiny compared to today.

*The views expressed on Brexit in this article are those of the author and not necessarily shared by International Airport Review.

Related topics

Aeronautical revenue, Brexit, Economy, Regulation and Legislation

Excellent analysis