The Airport Carbon Accreditation footprint and Africa’s airports carbon economy

- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Posted: 15 May 2023 | Enoch Opare Mintah | No comments yet

Enoch Opare Mintah, PhD candidate at Kingston University, London, discusses the transformation of Africa’s airport carbon economy and the role it will play in the race for decarbonisation.

African airports and their work toward carbon accreditation

The inception of the Airport Carbon Accreditation (ACA) programme in 2019, an independent assessment and recognition of airports’ efforts in their measurement, management and reduction of carbon emissions through a six level certification framework, has been a game changer in carbon mitigation intervention for the aviation industry.

The inevitable alignment of the aviation sector’s climate goal to the Paris Agreement and the International Air Transport Association’s (IATA) Fly Net Zero, coupled with the International Civil Aviation Organisation’s (ICAO) courageous directive of net zero by 2050 as the global target for civil aviation, is a momentous leap forward for the overall climate aspiration of the industry’s ecosystem. The 2022 ACA report highlights some key achievements of the programme. Notable amongst them for the purposes of this article is the 30% rise in accreditation globally with 89 carbon neutral airports evidencing a key player (airports) in the aviation ecosystem poised in accelerating its efforts to reaching its net zero target by 2050.

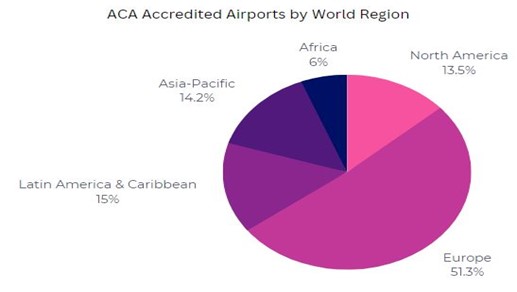

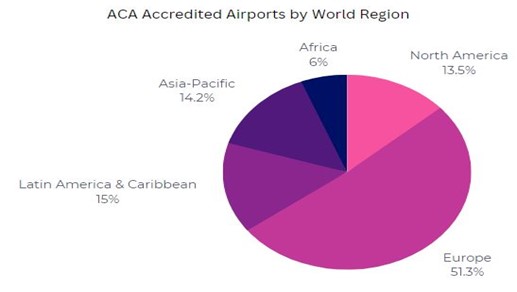

Africa, inarguably the continent that contributes the least share of carbon emissions, has embraced the ACA framework joining the race of not simply adding to the reduction figures, but aiming to reach the 2050 net zero target possibly way before the leading contributors. Although the least continent with ACA accredited airports of 6%, the 2019 passenger traffic figures of 95 million and the projection of the continent as one of the fastest-growing aviation hubs, and most importantly, the prospective impact of the African Union Agenda 2063 of realising the Single African Air Transport Market (SAATM), translates to a highly potential post-pandemic active business environment with a corresponding increase in carbon emissions (ceteri paribus).

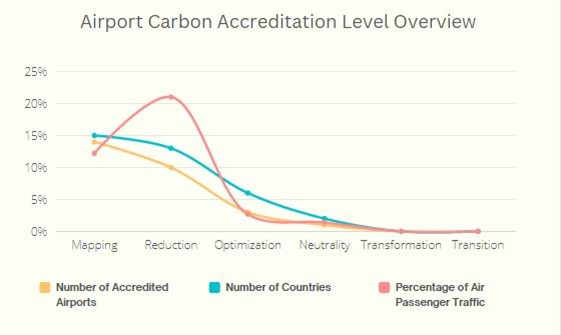

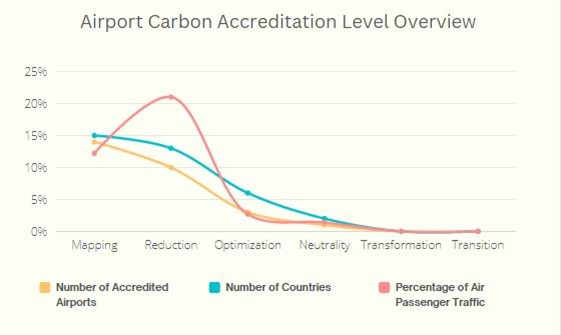

ACA outlook and ACI lead

As the least continental contributor of CO2 emissions (using this as a baseline for cross-continental industry comparatives) yet the most impacted, the African airports sector has an option to wait for the big contributors to show them the ‘yellow card’ or choose to develop an inside-out cum collaborative approach to mitigate the contribution and negate the impact of CO2 emissions. The ACA release reports 28 active airports within the carbon emissions scope from Mapping (14), Reduction (10), Optimisation (3) to Neutrality (1) all accounting for 37.3% of total air passenger traffic on the continent. As laudable as this may sound, these figures merely represent a small pie of the number of airports facilities on the continent. Whether we stick to the Airport Council International-Africa (ACI-Africa) Membership of 260 or use the Airport Code sample of 477 airports, the results are clear: merely 11% or 6% of the continent’s airport market respectively are ACA accredited. Using the number of countries indicator, only eight and seven countries out of 54 on the continent have airports accredited on the Mapping and Reduction level respectively.

Graphical presentation by Author

Graphical presentation by Author

You may argue about the ‘quiet revolution’ or the unaccounted efforts of airports who are doing amazingly well behind the scenes but the counter argument is that; first; applying uncoordinated, untested, unverified and “what I deem fit syndrome” measurements in a closet makes it difficult to manage and track the communal efforts in reaching the common goal and second; application of a unifying framework provides that rigor for efficient emissions measurement, disclosure management and assurance. This small pie of accreditations calls for a robust advocacy, collaborative and policy discourse strategy spearheaded by ACI World with key players within and without the industry on the continent to garner both the corporate and political will of stakeholders to increase the industry’s gains on the African continent owing to the eminence of the climate crisis and the pressure on the industry to decarbonise.

Big airport players take the lead

In making a good case for the adoption of climate related practices and disclosures in an industry, one of the pivotal junctures in accelerating the pace is when large entities show a commitment to both practice and disclosure. Having nine of the top 20 busiest airports both in passenger and freight traffic accredited at the Mapping and Reduction levels is a significant quota for the airport sector decarbonisation which cannot be overlooked.

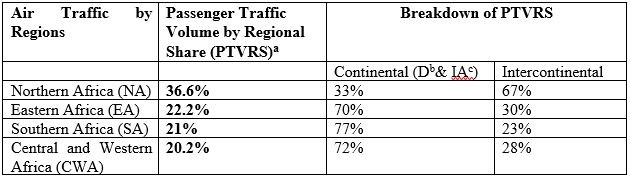

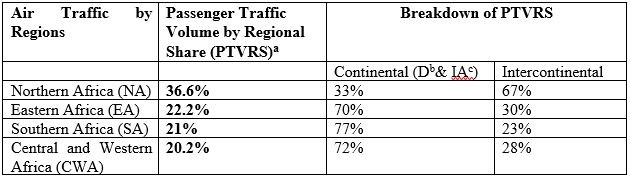

Table created by Author/ Compared and complied from three web sources (Talkafricana, 2022; Africanexponent, 2022; Gettocenter, 2022) and AFRAA Air Transport Report (2020)

The importance of having these leading airports spearheading this industry intervention is that it paves the way for medium airports to emulate the former while receiving mentorship and support to drive the whole carbon reduction economy in their respective regions and countries of operation.

Rethinking ACA ownership and strategy

According to the AFRAA Air Transport Report (2020), the continent’s air passenger traffic distribution shows 43% to domestic and 57% to international travel where the latter accounts for 19% of intra Africa and 38% of intercontinental. Reworking these percentages results in a 62% share of passenger traffic (domestic + intra Africa) within the continent.

Table created by Author/ a Passenger Traffic Volume by Regional Share (PTVRS) Pre-COVID-19 figures, bD – Domestic, cIntra Africa, AFRAA Air Transport Report (2020).

Using the pre-pandemic figures as the baseline for this exposition, NA region has the most of the passenger traffic volume of approximately 37% and calls for the development of a roadmap to increasing ACA in the region. The breakdown of the Passenger Traffic Volume by Regional Share (PTVRS) shows that over 70% (apart from NA) of continental travel, evidencing a huge amount on internally generated emissions volume is accounted for by activities within the continent. Thus, in making an argument for the adoption of ACA, airports in Africa need to own and adopt an inside-out approach in developing a local-centric approach to embedding the core competences and values of ACA in its decarbonisation strategy to negate its internally generated CO2 emissions target.

Carbon offset market

This process of ownership and localisation of the ACA is critical and strategic in boosting the local carbon offset market on the continent while creating alternative sources for climate financing. The achievement of both is anchored on the strength of the advocacy strategy of individual airports and collective as an industry to create the needed awareness amongst its stakeholders while engaging the policy community to help regularise the carbon economy on the continent. The African Continental Free Trade Area (AfCFTA) initiative and secretariat for example can be one of the strategic stakeholders to partner for the acceleration of the carbon market for the airport and wholly the aviation industry.

Carbon capture technologies

The carbon capture technologies market in Africa is not as robust as in developed countries not because of the absence of a technological will especially from young technology enthusiasts, but the enabling environment including the financing needed both at the governmental and private level to support the creation of an ecosystem that funds these technologies on the continent for the continent is missing.

The transformation of Africa’s airport carbon economy is crucial in the carbon emissions race as the recent UN IPCC report calls for a fast-track approach in cutting emissions considerably to meet the Paris 1.5C agreement. Whereas the inception of the ACA framework has been a breakthrough for the airport industry across the globe, the case for the African continent has been a good leap and step in the right direction. The decarbonisation strategy of airports will need more than an outside-in approach to increasing accreditation and stakeholder involvement. It will require an inside-out approach evidenced through a proactive ownership position aimed at embedding sustainability, improvement of disclosure practices and a robust policy framework while developing a financing strategy to support new technologies and projects to accelerate decarbonisation. The framework, disclosure practices, carbon market, investment in carbon technologies and financing altogether will be integral in defining Africa’s airport carbon economy contribution to the continent’s decarbonisation pie.

Enoch Opare Mintah is a PhD candidate at Kingston University, London and an Associate Lecturer of Governance at the University of Lincoln, UK. He holds an MBA (University of Liverpool, UK), MSc Governance (University of Lincoln, UK), Cert. Hospitality and Tourism Management (Florida Atlantic University, USA) and BA English (KNUST, Ghana).

He is a member of the British Accounting and Finance Association (BAFA), European Accounting Association (EAA), Institute of Corporate Responsibility and Sustainability (ICRS-UK), Chartered Governance Institute UK and Ireland (GradCG) and Association of MBAs’ (AMBA).

His research interest revolves around environmental, social and governance (ESG) disclosures; sustainability reporting; corporate social responsibility; non-profit leadership and education for sustainable development.

Enoch has worked with multi-nationals, including large and small for-profit and non-profit organisations across the globe. Continents include Africa, Europe and Asia and he has successfully delivered several international projects – to global recognition.

Related topics

Airport Carbon Accreditation (ACA), Emissions, Sustainability

Related airports

Bole International Airport, Cairo International Airport (CAI), Cape Town International Airport (CPT), Casablanca Mohammed V Airport (CMN), Dar es Salaam International Airport, Houari Boumediene Airport, Hurghada International Airport (HRG), Jomo Kenyatta International Airport (JKIA), Julius Nverere International Airport, King Shaka International Airport, Kotoka International Airport, Marrakesh Menara Airport (RAK), Monastair Habib Bourguiba International Airport, Murtala Muhammed International Airport, Nnamdi Azikiwe International Airport, O.R Tambo International airport, Quatro de Fevereiro Airport, Sharm El-Sheikh International Airport, Sir Seewoosagur Ramgoolam International Airport, Tunis Carthage International Airport

Related organisations

African Continental Free Trade Area, Airports Council International Africa (ACI Africa), British Accounting and Finance Association (BAFA), Chartered Governance Institute UK and Ireland (GradCG), Institute of Corporate Responsibility and Sustainability (ICRS-UK), International Air Transport Association’s (IATA), International Civil Aviation Organisation’s (ICAO), Single African Air Transport Market