Airport capital investment: Addressing challenges beyond the pandemic

Posted: 30 August 2021 | Janik Gagne | No comments yet

Janik Gagné, Senior Director, Economic Analysis and Statistical Services, at Airports Council International (ACI) World, talks to International Airport Review about projected passenger demand in the future and the CAPEX required to address this.

Airports play a pivotal role in the aviation ecosystem. They facilitate the transport of people and goods within and between national and international economies. The economic value driven by airports cannot be understated when it comes to facilitating business and leisure travel, trade, and the subsequent GDP, jobs, taxes, and associated social benefits. The connectivity provided to both domestic and international destinations support local and national economic activity. Airports and the aviation sector serve as economic engines.

One recent study published by the Air Transportation Action Group (ATAG)1 showed that, in 2019, the aviation sector generated $3.5 trillion in economic activity, representing 4.5 per cent of global GDP. The transport of 9.1 billion air passengers and $6.5 trillion in goods also supported 87.7 million jobs around the world.

Airports play a pivotal role in the aviation ecosystem. They facilitate the transport of people and goods within and between national and international economies. The economic value driven by airports cannot be understated when it comes to facilitating business and leisure travel, trade, and the subsequent GDP, jobs, taxes, and associated social benefits. The connectivity provided to both domestic and international destinations support local and national economic activity. Airports and the aviation sector serve as economic engines.

One recent study published by the Air Transportation Action Group (ATAG)1 showed that, in 2019, the aviation sector generated $3.5 trillion in economic activity, representing 4.5 per cent of global GDP. The transport of 9.1 billion air passengers and $6.5 trillion in goods also supported 87.7 million jobs around the world.

Future airport capital investment needs

After a decade of consistent and robust growth in global passenger traffic, the ongoing COVID-19 pandemic brought airports around the world to a virtual halt in the second quarter of 2020, erasing almost overnight, more than 20 years of passenger traffic growth. The vaccination effort of historical proportions now well underway in many countries points to positive signs of a gradual reopening of parts of the economy in countries with high vaccination rates. The recovery of the sector to pre-COVID-19 levels is expected by 2023 for domestic travel and by 2024 for international travel, before resuming long‑run passenger growth trends. As the world recovers unevenly, both socially and economically, the long-run fundamentals of aviation demand remain clear. ACI World projections indicate that close to 19.7 billion passengers will traverse the world’s airports by 2040 – more than double the 2019 air passenger levels.2

Pre-COVID-19, capacity constraints were a problem faced by airports worldwide; many of them were already operating above their declared capacity, leading to bottlenecks and flight delays. With passenger traffic expected to return to pre‑COVID-19 levels within two to three years and increase significantly in the long-run, many more airports may reach the point where the demand outstrips the available airport infrastructure.

In normal times, addressing the capacity constrains due to the growth of passenger demand poses already a significant challenge, but the pandemic, by dramatically reducing airport revenues, just added an even greater challenge for airports to meet long-term capacity needs. The estimated decline in capital expenditure (CAPEX)3 between the pre-COVID-19 baseline year of 2019 and 2020 is 33 per cent or about $28 billion, and it is projected to partially recover to about 14 per cent (approximately $12 billion) below the 2019 baseline in 2021. The varying recovery rates for both domestic and international passengers will likely also result in uneven resumption of airport capital investment. For example, some airports have opted to expedite capital projects leveraging the reduction in aircraft movements and low passenger volumes, while others suspended projects or deferred capital plans.

To meet future air passenger demand will require investment in new greenfield airports, as well as significant investment to expand and maintain existing airport infrastructure. Between 2021 and 2040, projections indicate approximately $2.4 trillion in airport total capital investments will be needed to address the long-term trend in passenger demand.4 The sheer size of this estimate is impressive – $2.4 trillion corresponds to more than Italy’s annual GDP. Of this amount, 30 per cent of the CAPEX needs are for new greenfield airport construction, representing $731 billion between 2021 and 2040.

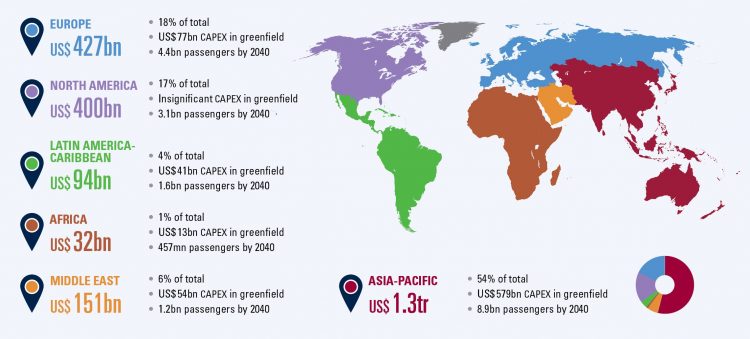

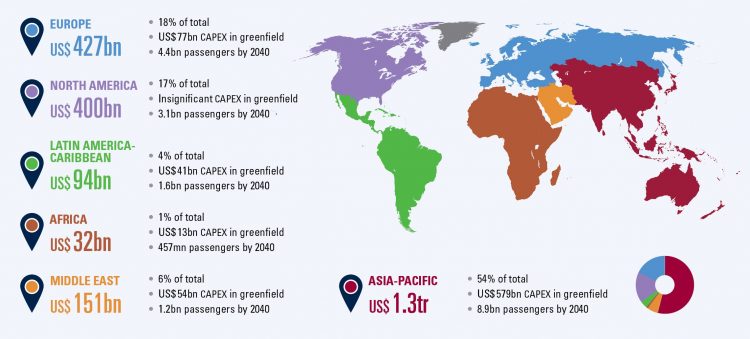

Chart 1: 2021 – 2040 total needed capital expenditure by region.

Source: ACI World (2021). Global Outlook of Airport Capital Expenditure: Meeting Sustainable Development Goals and Future Air Travel Demand.

The size of the needed investment differs greatly from one region to another (see Chart 1 above).

- Asia-Pacific comprises about $1.3 trillion of needed 2021 to 2040 CAPEX, more than half of the global CAPEX required. This reflects the region’s rapid passenger growth and subsequent demand to develop new greenfield airports, as well as to modernise and expand existing airport infrastructure. New greenfield airport construction (44 per cent of the region’s total CAPEX needed) will be needed to support the capacity needs of passenger growth across the region.

- Europe’s needs are estimated at $427 billion CAPEX. More than half of this investment is expected in terminals to maintain and retrofit the region’s aging infrastructure, as well as address capacity constraints in the face of growing passenger demand.

- On the other side of the Atlantic, North America’s roughly $400 billion needed 2021‑2040 CAPEX represents about 17 per cent of the global total. High costs are associated with maintaining the region’s aging infrastructure, coupled with the demand to expand existing airport capacity. Projections suggest that new greenfield airports are very minimal.

- The Middle East projected CAPEX needs amount to about $151 billion between 2021 and 2040. Near-term (2021-2025) greenfield airport projects are expected to comprise of more than half of total near-term CAPEX for the region. This share will gradually decrease over the long-run (2026-2040), as the region meets long-run air passenger capacity needs.

- Latin America-Caribbean’s 2021-2040 airport CAPEX need represents an investment of about $94 billion. The strong passenger demand growth in the region compared to the limited airport availability and capacity, means that about 45 per cent of total investment over the 20-year period will be required for new greenfield developments.

- Africa’s forecast 2021-2040 CAPEX needs exceed $32 billion. While the region’s aviation industry is still emerging, the pace of needed new greenfield airport investment will be similar to Latin America-Caribbean and represents nearly 40 per cent of the projected total CAPEX need.

The heavy cost of falling short of needed capital investment

Beyond the recovery from the COVID-19 pandemic, the focus will be to provide sustainable long-term growth for the industry. While technology, aircraft size, load factors, and other capacity-mitigating measures can partially address constraints in the short-run, the key conclusion is that unaddressed airport capacity constraints will have real impacts on long-run future passenger flows. These capacity constraints require capital investment to remedy.

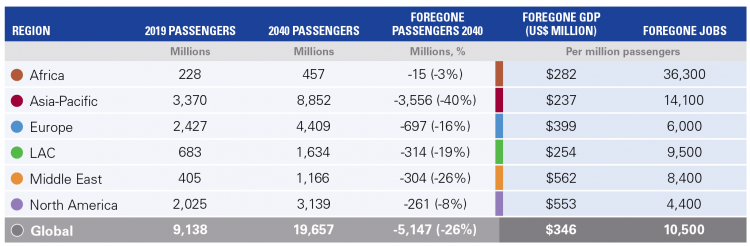

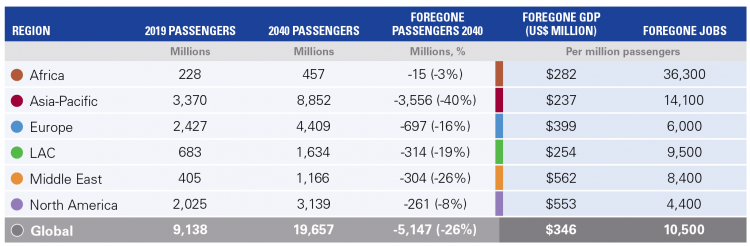

Failure to address capacity needs to realise projected 2040 passenger demand will have real socio-economic consequences. Based on the relationship between passenger travel and socio-economic outcomes, for every one million foregone passenger journeys due to airport capacity constraints in 2040, the global air transport industry would support 10,500 fewer jobs and $346 million less in GDP. Estimates of potentially foregone passengers due to unmitigated capacity constraints through airport capital investment suggests that up to 5.1 billion passengers may not be realised by 2040.

Meeting environmental goals

According to the International Council on Clean Transportation (ICCT), from an emissions standpoint, the aviation sector was responsible for about 918 million metric tons of CO2 in 20185. This represents about two per cent of all ‘humaninduced’ CO2 output.6 Airports – a subcomponent of global aviation – account for about two per cent of carbon emissions in the air travel sector.7

From an environmental and social standpoint, facilitating the transportation of billions of passengers and trillions of dollars of goods annually brings responsibilities for the global airport industry. The growth in passenger demand will put increased pressure on airports to expand capacity to accommodate and facilitate the traveller flows in a manner that aligns to environmentally sustainable targets, particularly decarbonisation goals, while also proactively fortifying infrastructure against emerging climate change and challenges to health and human safety.

Chart 2: Potential foregone passengers in 2040 due to capacity constraints and related economic impacts

Source: ACI World (2021). Global Outlook of Airport Capital Expenditure: Meeting Sustainable Development Goals and Future Air Travel Demand.

Commitments to UN Sustainable Development Goals (SDGs)8 and decarbonisation targets will likely require additional medium- to long-term capital spending adjustments to achieve these sustainability, resilience, and emission-reduction goals. The steps required for airports to achieve decarbonisation goals are dependent on several factors that affect both CAPEX and Operating Expenditure (OPEX) decisions. Therefore, the capital investment pathway to reduce carbon emissions will differ by region and even by airports, and is highly dependent on the availability of clean electrical grid. For some airports, capital investments may be necessary in on-site renewables, as well as vehicle fleet to fully decarbonise, but the shift to cleaner electrical grids will represent the greatest gains in emission reductions, highlighting the importance of the access to ‘decarbonised’ electricity. The myriad of pathways toward decarbonisation goals are thoroughly described in the Long-Term Carbon Goal study published by ACI World.9

The way forward

Airport infrastructure is key to the continued development of air transport which supports millions of jobs and provides social and economic development for the global communities we serve. Implications of falling short to address capacity needs suggest slower economic recovery and unrealised long-term growth, in addition to increases in unmitigated CO2 emissions.

The global airport community remains committed to effectively contribute to the UN SDGs. In the short-run, airport operators may require financial assistance and short-term loans to weather the COVID-19-induced economic storm. Governments will play an important role in supporting and incentivising recovery and to mitigate the risks of falling short on certain SDGs linked to airports and aviation.

References

- Air Transport Action Group (September 30, 2020). Aviation: Benefits Beyond Borders. https://aviationbenefits.org/downloads/aviation-benefits-beyond-borders-2020/

- ACI World (2021). World Airport Traffic Forecasts 2020-2040.

- Funds used by an airport operator for the acquisition, construction, or improvement of fixed assets such as land and buildings. These expenditures can include everything related to the increase in airport capacity, ranging from additional check-in desks to building a new terminal building or runway.

- ACI World (2021). Global Outlook of Airport Capital Expenditure: Meeting Sustainable Development Goals and Future Air Travel Demand. store.aci.aero/CAPEX

- Graver, Brandon, et. al. (Octobre, 2020). CO2 Emissions from Commercial Aviation: 2013, 2018 and 2019. ICCT. https://theicct.org/sites/default/files/publications/CO2-commercial-aviation-oct2020.pdf

- Air Transport Action Group (2020). Facts and Figures. https://www.atag.org/facts-figures.html

- Airport Carbon Accreditation. Airports addressing their CO2 emissions. https://airportco2.org/

- The UN Sustainable Development Goals are a call for action by all countries— poor, rich, and middle-income— to promote prosperity while protecting the planet by 2030. These are captured across 17 goals. For airports in particular, SDGs #8 (decent work and economic growth), #9 (industry, innovation, and infrastructure), and #13 (climate action) have become central focuses of capital planning.

- ACI World (2021). Long Term Carbon Goal study. store.aci.aero/LTCG

Stay Connected with International Airport Review — Subscribe for Free!

Get exclusive access to the latest airport and aviation industry insights from International Airport Review — tailored to your interests.

✅ Expert-Led Webinars – Gain insights from global aviation leaders

✅ Weekly News & Reports – Airport innovation, thought leadership, and industry trends

✅ Exclusive Industry Insights – Discover cutting-edge technologies shaping the future of air travel

✅ International Airport Summit – Join our flagship event to network with industry leaders and explore the latest advancements

Choose the updates that matter most to you.

Sign up now to stay informed, inspired, and connected — all for free!

Thank you for being part of our aviation community. Let’s keep shaping the future of airports together!

Issue

Related topics

Airport construction and design, Airport development, Capacity, COVID-19, Economy, Emissions, Funding and finance, Passenger experience and seamless travel, Passenger volumes, Sustainability, Sustainable development