Air cargo demand softens in September 2022

- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Posted: 15 November 2022 | International Airport Review | No comments yet

For September 2022, the International Air Transport Association’s latest data figures demonstrate a soften in demand for global air cargo.

The International Air Transport Association (IATA) released data for September 2022 global air cargo markets showing that air cargo demand softened.

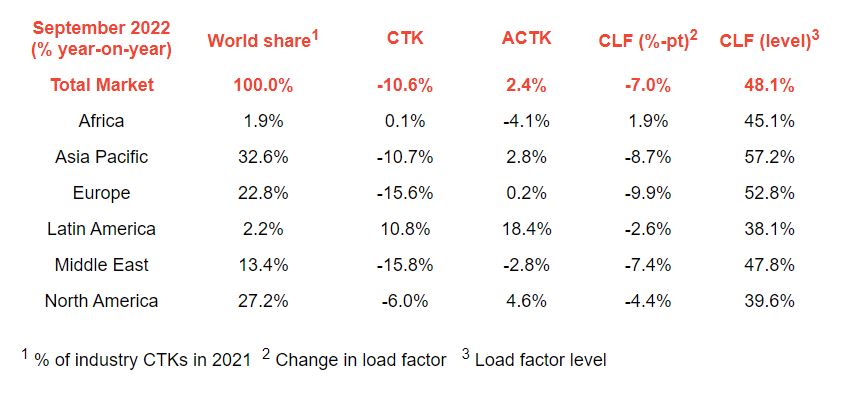

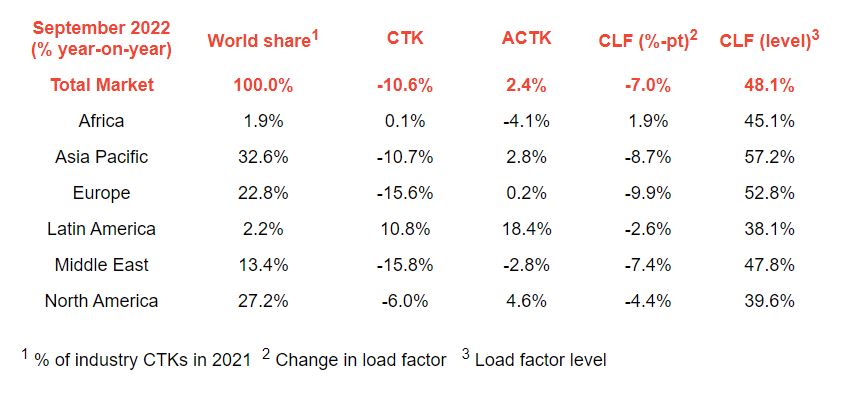

- Global demand, measured in cargo tonne-kms (CTKs), fell 10.6 per cent compared to September 2021 (-10.6 per cent also for international operations), but continued to track at near pre-pandemic levels (-3.6 per cent)

- Capacity was 2.4 per cent above September 2021 (+5.0 per cent for international operations) but still 7.4 per cent below September 2019 levels (-8.1 per cent for international operations)

- Several factors in the operating environment should be noted:

- Following contractions across major economies, the global Purchasing Managers Index (PMI) for new export orders also contracted (for a third month in a row) to its lowest level in two years

- Latest global goods trade figures showed a 5.2 per cent expansion in August, a positive sign for the global economy. This is expected to primarily benefit maritime cargo, with a slight boost to air cargo as well

- Oil prices remained stable in September and the jet fuel crack spread fell from a peak in June

- The Consumer Price Index stabilised in G7 countries in September, but at a decades high level of 7.7 per cent. Inflation in producer (input) prices slowed to 13.7 per cent in August.

“While air cargo’s activity continues to track near to 2019 levels, volumes remain below 2021’s exceptional performance as the industry faces some headwinds. At the consumer level, with travel restrictions lifting post-pandemic, people are likely to spend more on vacation travel and less on e-commerce. And at the macro-level, increasing recession warnings are likely to have a negative impact on the global flows of goods and services, balanced slightly by a stabilisation of oil prices. Against this backdrop, air cargo is bearing up well. And a strategic slow-down in capacity growth from 6.3 per cent in August to 2.4 percent in September demonstrates the flexibility the industry has in adjusting to economic developments,” said Willie Walsh, IATA’s Director General.

Credit: IATA

September Regional Performance

- Asia-Pacific airlines saw their air cargo volumes decrease by 10.7 per cent in September 2022 compared to the same month in 2021. This was a decline in performance compared to August (-8.3 per cent). Airlines in the region continue to be impacted by the conflict in Ukraine, labor shortages, and lower levels of trade and manufacturing activity due to Omicron-related restrictions in China. Available capacity in the region increased by 2.8 per cent compared to 2021

- North American carriers posted a 6.0 per cent decrease in cargo volumes in September 2022 compared to the same month in 2021. This was a decline in performance compared to August (3.4 per cent). Capacity was up 4.6 per cent compared to September 2021

- European carriers saw a 15.6 per cent decrease in cargo volumes in September 2022 compared to the same month in 2021. This was on a par with August’s performance (-15.1 per cent). This is attributable to the war in Ukraine. Labor shortages and high inflation levels, most notably in Turkey, also affected volumes. Capacity increased 0.2 per cent in September 2022 compared to September 2021

- Middle Eastern carriers experienced a 15.8 per cent year-on-year decrease in cargo volumes in September 2022. This was the worst performance of all regions and a significant decline compared to the previous month (-11.3 per cent). Stagnant cargo volumes to/from Europe impacted the region’s performance. Capacity was down 2.8 per cent compared to September 2021

- Latin American carriers reported an increase of 10.8 per cent in cargo volumes in September 2022 compared to September 2021. This was the strongest performance of all regions. Airlines in this region have shown optimism by introducing new services and capacity, and in some cases investing in additional aircraft for air cargo in the coming months. Capacity in September was up 18.4 per cent compared to the same month in 2021

- African airlines saw cargo volumes increase by 0.1 per cent in September 2022 compared to September 2021. This was a slight decrease in the growth recorded the previous month (1.0 per cent). Capacity was 4.1 per cent below September 2021 levels.

Related topics

Air freight and cargo, Airside operations, Capacity, Terminal operations