May 2022 air cargo buoyed by easing of COVID-19 restrictions in China

- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Posted: 12 July 2022 | International Airport Review | No comments yet

The International Air Transport Association has released May 2022 data for global air cargo markets, demonstrating that the easing of Omicron restrictions in China has helped to relieve supply chain constraints.

The International Air Transport Association (IATA) released May 2022 data for global air cargo markets showing that the easing of COVID-19 Omicron restrictions in China helped to alleviate supply chain constraints and contributed a performance improvement for the month of May.

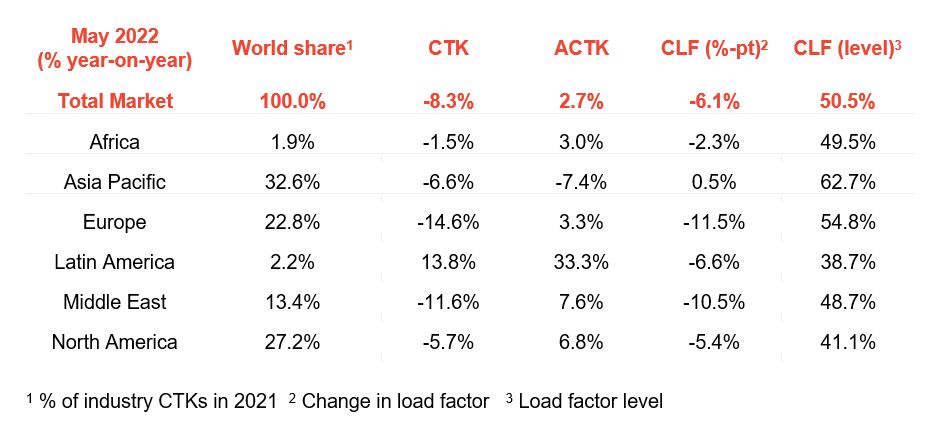

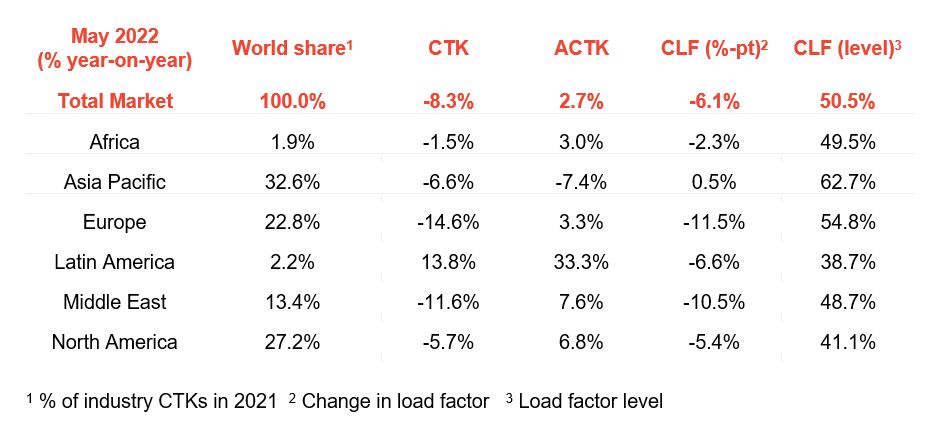

Note: IATA have returned to year-on-year traffic comparisons, instead of comparisons with the 2019 period, unless otherwise noted.

- Global demand, measured in cargo tonne-km (CTKs), was 8.3 per cent below May 2021 levels (-8.1 per cent for international operations). This was an improvement on the year-on-year decline of 9.1 per cent seen in April 2022

- Capacity was 2.7 per cent above May 2021 (+5.7 per cent for international operations). This more than offset the 0.7 per cent year-on-year drop in April 2022. Capacity expanded in all regions with Asia to Pacific experiencing the largest growth

- Air cargo performance is being impacted by several factors

- Trade activity ramped-up slightly in May 2022 as lockdowns in China due to Omicron were eased. Emerging regions also contributed to growth with stronger volumes

- New export orders, a leading indicator of cargo demand and world trade, decreased in all markets, except China

- The war in Ukraine continues to impair cargo capacity used to serve Europe as several airlines based in Russia and Ukraine were key cargo players.

“May offered positive news for air cargo, most notably because of the easing of some Omicron restrictions in China. On a seasonally adjusted basis, we saw growth (0.3 per cent) after two months of decline. The return of Asian production as COVID-19 measures eased, particularly in China, will support demand for air cargo. And the strong rebound in passenger traffic has increased belly capacity, although not always in the markets where the capacity crunch is most critical. But uncertainty in the overall economic situation will need to be carefully watched,” commented Willie Walsh, IATA’s Director General.

Credit: IATA

May regional performance

- Asia-Pacific airlines saw their air cargo volumes decrease by 6.6 per cent in May 2022 compared to the same month in 2021. This was a significant improvement over the 15.8 per cent decline in April 2022. Airlines in the region have been heavily impacted by lower trade and manufacturing activity due to Omicron-related lockdowns in China however this started to ease in May 2022 as restrictions were lifted. Available capacity in the region fell 7.4 per cent compared to May 2021

- North American carriers posted a 5.7 per cent decrease in cargo volumes in May 2022 compared to May 2021. Demand in the Asia to North America market remained subdued, however, other key routes such as Europe to North America remain strong. Capacity was up 6.8 per cent compared to May 2021. Several carriers in the region are set to receive delivery of freighters this year, which should help address pent-up demand on routes where it is needed if economic headwinds do not persist

- European carriers saw a 14.6 per cent decrease in cargo volumes in May 2022 compared to the same month in 2021. This was the worst performance of all regions. This is attributable to the war in Ukraine. Labor shortages and lower manufacturing activity in Asia due to Omicron also affected volumes. Capacity increased 3.3 per cent in May 2022 compared to May 2021

- Middle Eastern carriers experienced a 11.6 per cent year-on-year decrease in cargo volumes in May 2022. Significant benefits from traffic being redirected to avoid flying over Russia failed to materialise. This is likely due to persisting supply chain issues in Asia. Capacity was up 7.6 per cent compared to May 2021

- Latin American carriers reported an increase of 13.8 per cent in cargo volumes in May 2022 compared to May 2021. This was the strongest performance of all regions. Airlines in this region have shown optimism by introducing new services and capacity, and in some cases investing in additional aircraft for air cargo in the coming months. Capacity in May 2022 was up 33.3 per cent compared to the same month in 2021

- African airlines saw cargo volumes decrease by 1.5 per cent in May 2022 compared to May 2021. This was significantly slower than the growth recorded the previous month (6.3 per cent). Capacity was 3.0 per cent above May 2021 levels.

Related topics

Air freight and cargo, Aircraft, Airside operations, Capacity, Cargo, COVID-19